Maximize Your Reimbursement with a Hassle-Free Australian Online Tax Return Service

Maximize Your Reimbursement with a Hassle-Free Australian Online Tax Return Service

Blog Article

Explore How the Online Tax Obligation Return Process Can Streamline Your Tax Filing

The online income tax return process has changed the means individuals approach their tax filings, providing a level of benefit that standard approaches commonly lack. By leveraging easy to use software, taxpayers can browse the intricacies of tax obligation preparation from the convenience of their homes, dramatically minimizing the time and effort involved. Trick features such as automated estimations and real-time error checks not just simplify the experience however likewise enhance precision and possible cost savings. Comprehending the full range of these benefits and just how to maximize them needs more exploration right into particular capabilities and finest practices.

Advantages of Online Tax Obligation Filing

The benefits of on-line tax declaring are numerous and considerable for taxpayers looking for performance and accuracy. One main advantage is the convenience it provides, enabling individuals to finish their income tax return from the convenience of their own homes at any type of time. This removes the need for physical trips to tax workplaces or waiting in lengthy lines, thus saving useful time.

An additional famous advantage is the rate of processing; electronic entries usually result in quicker reimbursements compared to traditional paper filings. Taxpayers can additionally gain from enhanced protection procedures that safeguard delicate personal details during the declaring procedure.

Furthermore, on the internet declaring systems usually provide access to numerous resources, consisting of tax ideas and Frequently asked questions, encouraging taxpayers to make enlightened decisions. Australian Online Tax Return. Overall, these benefits contribute to a streamlined filing experience, making on the internet tax obligation submitting a recommended selection for many people and businesses alike

Step-by-Step Declaring Process

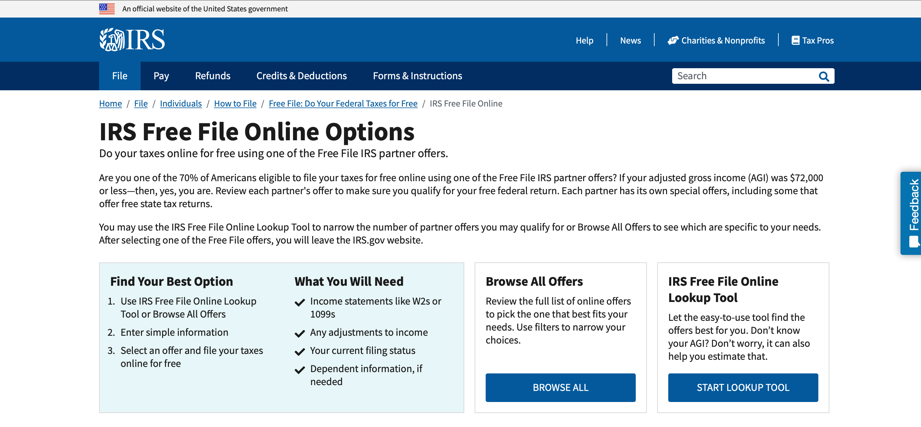

To effectively navigate the on-line tax obligation return process, taxpayers can follow a simple, step-by-step approach. Individuals ought to gather all required documentation, including W-2 kinds, 1099s, and invoices for reductions. This prep work makes sure that all appropriate monetary information is readily offered.

Following, taxpayers require to choose a respectable on the internet tax software or platform. Several alternatives exist, so it is vital to select one that fits personal needs, consisting of individual experience and the complexity of the tax scenario. When the software application is selected, customers need to produce an account and input their personal details, such as Social Safety numbers and filing status.

The following step entails going into income information and any applicable reductions and credit reports. Taxpayers ought to carefully comply with prompts to make certain accuracy. After finishing these areas, it is important to assess the details for errors or noninclusions. Many systems provide a testimonial function that highlights potential problems.

Usual Features of Tax Software Program

Tax obligation software program generally integrates a selection of features developed to simplify the filing process and boost user experience. One of one of the most notable functions is straightforward user interfaces that direct taxpayers with each action, ensuring that even those with restricted tax obligation knowledge can navigate the intricacies of tax obligation prep work.

Additionally, lots of tax obligation software application offer automated data entrance, permitting customers to import financial information directly from different resources, such as W-2 kinds and financial institution declarations, which significantly decreases the possibilities of mistakes. Some systems additionally give real-time mistake monitoring, alerting users to potential mistakes before submission.

Additionally, tax obligation software application commonly consists of tax obligation calculators that assist estimate potential reimbursements or liabilities, enabling users to make informed click decisions throughout the declaring procedure. Several applications additionally include durable tax obligation deduction and credit score finders that assess customer inputs to determine suitable tax benefits, taking full advantage of prospective cost savings.

Safety And Security and Privacy Measures

Making certain the safety and personal privacy of delicate monetary info is critical in the online income tax return procedure. Tax obligation prep work services utilize innovative security procedures to protect information throughout transmission. This file encryption guarantees that individual details stays inaccessible to unapproved celebrations, considerably reducing the threat of data breaches.

Additionally, credible tax software carriers carry out multi-factor authentication (MFA) as an included layer of safety and security. MFA requires individuals to verify their identification through numerous channels, such as a sms message or email, prior to accessing their accounts. This procedure not only improves security yet also aids in avoiding unapproved access.

In addition, numerous systems comply with sector standards and guidelines, such as the Payment Card Market Data Safety Criterion (PCI DSS) and the General Data Defense Regulation (GDPR) Conformity with these laws guarantees that customer data is managed sensibly and reduces the threat of misuse. - Australian Online Tax Return

Regular safety audits and vulnerability evaluations are done by these systems to identify and attend to possible weaknesses. By integrating these safety measures, the online tax obligation return procedure cultivates a protected atmosphere, permitting customers to file their taxes with confidence, understanding that their delicate details is protected.

Tips for a Smooth Experience

Preserving safety and personal privacy throughout the on-line income tax return process lays the foundation for a smooth experience. To accomplish this, begin by selecting a trustworthy tax obligation software or company that utilizes strong file encryption and information security procedures. Make certain that the picked system is certified with internal revenue service laws and supplies secure login options.

Organize your documents beforehand to minimize get more stress during the declaring procedure. Collect W-2s, 1099s, and any kind of various other appropriate tax obligation files, categorizing them for easy access. Australian Online Tax Return. This prep work not only speeds up the process but also reduces the chance of missing out on critical details

Furthermore, make the effort to confirm all entries before entry. Mistakes can result in delays and potential audits, so a detailed testimonial is vital. Use built-in error-checking devices used by lots of tax software application, as these can capture typical mistakes.

Last but not least, submit your income tax return as very early as possible. Early filing allows even more time for any kind of required corrections and might accelerate your refund. Adhering to these ideas will aid guarantee a seamless and reliable on the internet tax return experience, inevitably simplifying your tax obligation filing trip.

Final Thought

:max_bytes(150000):strip_icc()/IRSDirectFile-ca42f3f059c7448f96e19187e4107d7a.jpg)

The on-line tax obligation return process has changed the means individuals approach their tax filings, supplying a degree of benefit that conventional methods usually do not have.The advantages of on-line tax filing are significant and countless for taxpayers looking for efficiency and precision. Complying with these tips will certainly assist ensure a smooth and efficient online tax obligation return experience, ultimately streamlining your tax declaring journey.

In verdict, the on the internet tax obligation return process offers considerable advantages that enhance the tax declaring experience. By leveraging the benefits of on the internet tax obligation filing, my response people can maximize their possible cost savings while decreasing the tension typically connected with typical filing approaches.

Report this page